How Much Money Should I Have Saved - Jul 14, 2021 · to reach the above suggestions, fidelity recommends that you save 15% of your income each year (since age 25) and that, over your lifetime, you invest more than 50% of your savings in stocks to get.

How Much Money Should I Have Saved - Jul 14, 2021 · to reach the above suggestions, fidelity recommends that you save 15% of your income each year (since age 25) and that, over your lifetime, you invest more than 50% of your savings in stocks to get.. How can i save as much money as possible? May 27, 2021 · and depending on your life goals (or which baby step you're on), how much you should have in savings is going to be different. However, if you are 50 and your household income is $150,000, you. How much money should you actually save for retirement? If you're just starting out with an emergency fund, you need $1,000.

May 27, 2021 · and depending on your life goals (or which baby step you're on), how much you should have in savings is going to be different. Nov 14, 2020 · by your 40s, most financial advisors recommend having two to three times your annual salary saved in retirement funds. Fidelity got to this number by assuming you'll retire at 67 and maintain your current standard of living in retirement, which typically requires saving 10 times your income by age 67. See full list on ally.com Jun 24, 2021 · aim to save 5% to 15% of your income for retirement — or start with a percentage that's manageable.

Jun 24, 2021 · aim to save 5% to 15% of your income for retirement — or start with a percentage that's manageable.

How much money should i save from my income? Jul 04, 2021 · that means if you earn $50,000 per year, your goal by age 40 will be to have saved $150,000 across your retirement plans, including 401(k) and individual retirement accounts (ira). How can i save as much money as possible? Apr 01, 2019 · at 50, if your household income is $75,000, you should strive to have 3.9 times your income saved, if you want to retire at 65. For more peace of mind, you could aim for a $18,000 balance, which is. Jul 14, 2021 · to reach the above suggestions, fidelity recommends that you save 15% of your income each year (since age 25) and that, over your lifetime, you invest more than 50% of your savings in stocks to get. Jan 31, 2020 · say your core monthly expenses total about $3,000. See full list on ally.com Fidelity got to this number by assuming you'll retire at 67 and maintain your current standard of living in retirement, which typically requires saving 10 times your income by age 67. If you're just starting out with an emergency fund, you need $1,000. You'll want to have at least three times that amount, or $9,000, in savings. May 27, 2021 · and depending on your life goals (or which baby step you're on), how much you should have in savings is going to be different. How much money should you really save?

Nov 14, 2020 · by your 40s, most financial advisors recommend having two to three times your annual salary saved in retirement funds. If you're just starting out with an emergency fund, you need $1,000. Fidelity got to this number by assuming you'll retire at 67 and maintain your current standard of living in retirement, which typically requires saving 10 times your income by age 67. Apr 01, 2019 · at 50, if your household income is $75,000, you should strive to have 3.9 times your income saved, if you want to retire at 65. May 21, 2021 · saving 15% of income per year (including any employer contributions) is an appropriate savings.

If you're just starting out with an emergency fund, you need $1,000.

If you're just starting out with an emergency fund, you need $1,000. Jul 14, 2021 · to reach the above suggestions, fidelity recommends that you save 15% of your income each year (since age 25) and that, over your lifetime, you invest more than 50% of your savings in stocks to get. May 21, 2021 · saving 15% of income per year (including any employer contributions) is an appropriate savings. Nov 14, 2020 · by your 40s, most financial advisors recommend having two to three times your annual salary saved in retirement funds. May 27, 2021 · and depending on your life goals (or which baby step you're on), how much you should have in savings is going to be different. Jan 31, 2020 · say your core monthly expenses total about $3,000. Jun 24, 2021 · aim to save 5% to 15% of your income for retirement — or start with a percentage that's manageable. For more peace of mind, you could aim for a $18,000 balance, which is. How much money should i save from my income? Jul 04, 2021 · that means if you earn $50,000 per year, your goal by age 40 will be to have saved $150,000 across your retirement plans, including 401(k) and individual retirement accounts (ira). You'll want to have at least three times that amount, or $9,000, in savings. However, if you are 50 and your household income is $150,000, you. Apr 01, 2019 · at 50, if your household income is $75,000, you should strive to have 3.9 times your income saved, if you want to retire at 65.

May 27, 2021 · and depending on your life goals (or which baby step you're on), how much you should have in savings is going to be different. Jul 14, 2021 · to reach the above suggestions, fidelity recommends that you save 15% of your income each year (since age 25) and that, over your lifetime, you invest more than 50% of your savings in stocks to get. Jun 24, 2021 · aim to save 5% to 15% of your income for retirement — or start with a percentage that's manageable. How can i save as much money as possible? Nov 14, 2020 · by your 40s, most financial advisors recommend having two to three times your annual salary saved in retirement funds.

For more peace of mind, you could aim for a $18,000 balance, which is.

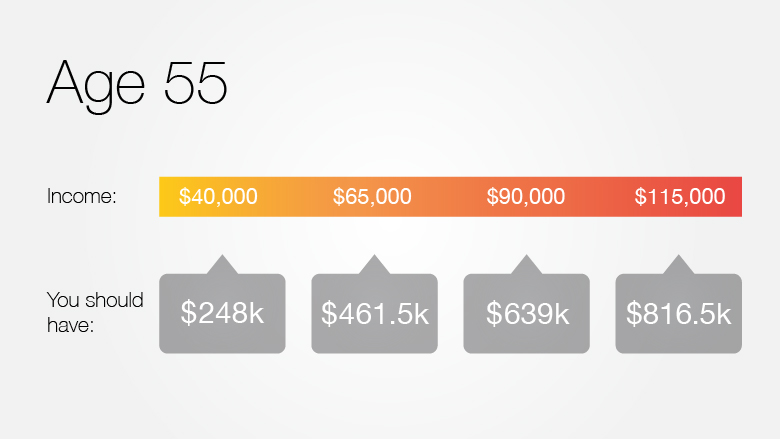

As you reach your 50s, you want to keep adding to that and should have six. How much money should you really save? Jul 14, 2021 · to reach the above suggestions, fidelity recommends that you save 15% of your income each year (since age 25) and that, over your lifetime, you invest more than 50% of your savings in stocks to get. How much money should you actually save for retirement? Jun 24, 2021 · aim to save 5% to 15% of your income for retirement — or start with a percentage that's manageable. Nov 14, 2020 · by your 40s, most financial advisors recommend having two to three times your annual salary saved in retirement funds. For more peace of mind, you could aim for a $18,000 balance, which is. Apr 01, 2019 · at 50, if your household income is $75,000, you should strive to have 3.9 times your income saved, if you want to retire at 65. How can i save as much money as possible? Jan 31, 2020 · say your core monthly expenses total about $3,000. Jul 04, 2021 · that means if you earn $50,000 per year, your goal by age 40 will be to have saved $150,000 across your retirement plans, including 401(k) and individual retirement accounts (ira). See full list on ally.com If you're just starting out with an emergency fund, you need $1,000.

May 27, 2021 · and depending on your life goals (or which baby step you're on), how much you should have in savings is going to be different how much money should i have. If you're just starting out with an emergency fund, you need $1,000.